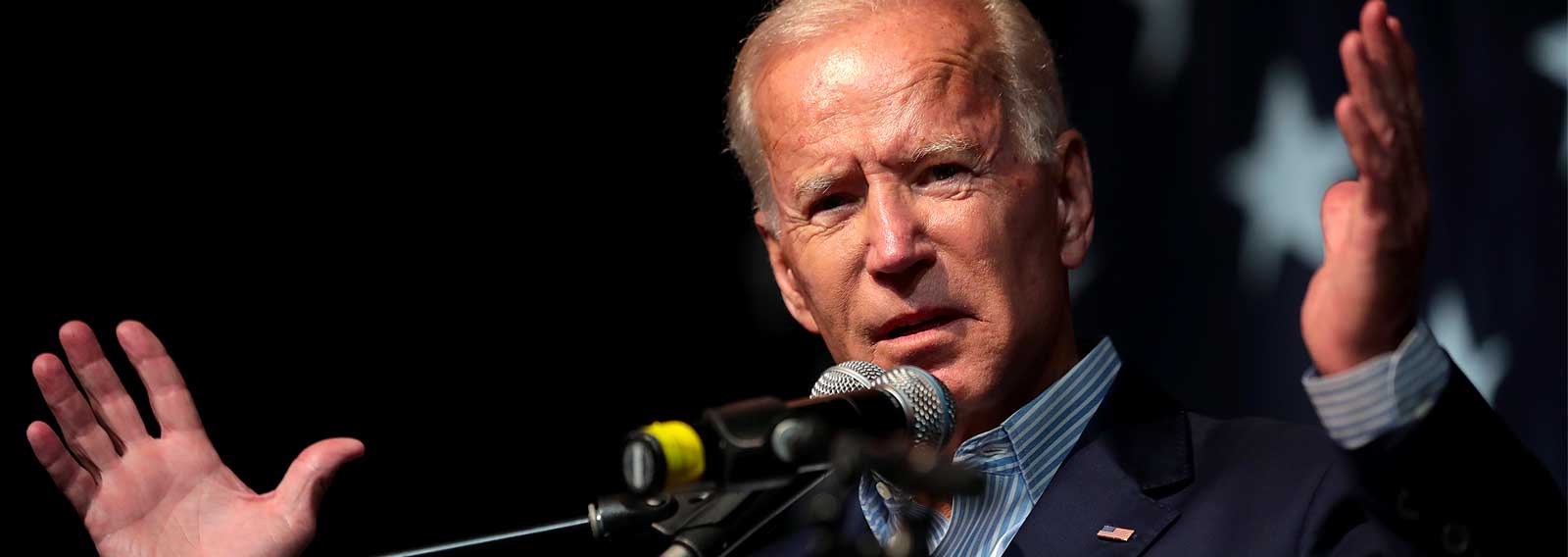

Video of an IRS simulation from 2017 has surfaced, providing an example of what accountants signing up for Joe Biden’s armed $80 billion gig can expect.

With Joe Biden’s inflation act seemingly gearing the IRS up for a civil war, Turning Point America co-founder, Charlie Kirk, posted the footage to YouTube, showing potential CI (Criminal Investigation) tax agents brandishing military hardware.

The 2017 annual event was a hands-on demonstration for ‘24 accounting students at Stockton University.’

An article posted by the University in October 2017 explained that students were “sworn in” as special agents in the morning, carried real, if older model, radios to communicate during surveillance, and wore IRS protective vests.

Each of the 24 budding militarised bean counters were also ‘armed with bright red or blue “handguns” as they stormed [mock] sites under investigation and made [mock] arrests.’

The simulation is designed to encourage accountants to branch out into the ‘exciting arena of criminal investigation,’ while still allowing them the use of their particular skill set.

Biden’s falsely termed ‘Inflation Reduction Act’ – more a trojan horse for forcing through “Climate Change” policies, and increasing the size of the Internal Revenue Service – is continuing to draw the ire and bewilderment of critics.

Former lieutenant governor of New York, Betsy McCaughey, wrote in an op-ed for the New York Post about how the IRS has been weaponized against political opponents in the past 100 years.

McCaughey concluded that the IRS has even more potential to be used as a tool for political persecution, given that the IRS is controlled by vindicative woke Democrats.

Despite Kamala Harris’ assurances that the bill only hurts those earning over $400,000 a year, McCaughey countered, ‘90% of the money raised through beefed-up audits will come from people making less than $200,000 a year – according to the bipartisan Joint Committee on Taxation.’

McCaughey’s more direct warnings followed Caldron Pool’s exposition on August 13, explaining how the Biden administration’s militarised IRS inflation act could see tax collectors target political opponents (see here and here).

Job Creators Network inferred that Democrats will use the IRS to come for the mums and dads of middle-class America.

This is because, JCN’s President, Elaine Parker told Breitbart:

“They passed a bill on the premise that Americans are tax cheats. Billionaires, millionaires, and large corporations, they have lawyers and accountants to fight the IRS for years in audits … you and me, small businesses, everyday ordinary Americans we don’t have the ability.”

In a Twitter thread discussing an article from The Hill, JCN asserted that small businesses will carry the burden because “Biden’s victory” over inflation is all show and no substance.

Biden’s ‘tax-and-spend legislation,’ wrote Alfredo Ortiz will only worsen the economic turmoil being felt by small businesses on the frontline of the economy.’

Government spending on ‘Democrats’ climate and health care projects, including extending expanded ObamaCare subsidies,’ he explained, will fuel inflation, and increase taxation.

The current administration ‘and the media are trying to gaslight Americans about the inflation crisis,’ [..] and ‘the silence of the countless media “fact-checkers” in response to Biden’s [false] assertions is deafening,’’ said Ortiz.

Fact-checking Joe Biden’s campaign reassurances in 2020, when he tried to soften proposed tax hikes by saying he was only after the “wealthy who earn $400,000 plus a year,” CNBC stated:

“Those making $400,000 or more in income belong to a rarefied group. They represent the top 1.8% of taxpayers, earning about 25% of the nation’s income […] $400,000 may provide for a luxurious life in West Virginia or Alabama, it provides for a less lavish lifestyle in big U.S. cities.”

The criticisms make sense.

With many on the Left conditioned to think that anyone not a Democrat, is a domestic terrorist, there is just cause for concern about what the Left might do with an agency as powerful as the Internal Revenue Service.

If you’re still not convinced. Follow the pattern.

Start with the potential for abuse permitted by the Biden White House’s (now failed) Ministry of Truth (or Department of Disinformation), and his Four Pillar plans for a War of Terror on Domestic Terrorism.

More to the point: why enlarge the IRS, and further weaponize the agency to almost the size of the United States Marines, if the government is only going after the 2% earning over $400,000 per annum?

You must be logged in to post a comment.