More than 308,000 people within the United Kingdom are backing Great Britain News’ feisty campaign to keep cash.

The Don’t Kill Cash July 4th movement exceeded its 250,000-signature goal by August 17.

The purpose of the petition is to stop a cashless society from turning British subjects into slaves of social credit scores, and a surveillance state.

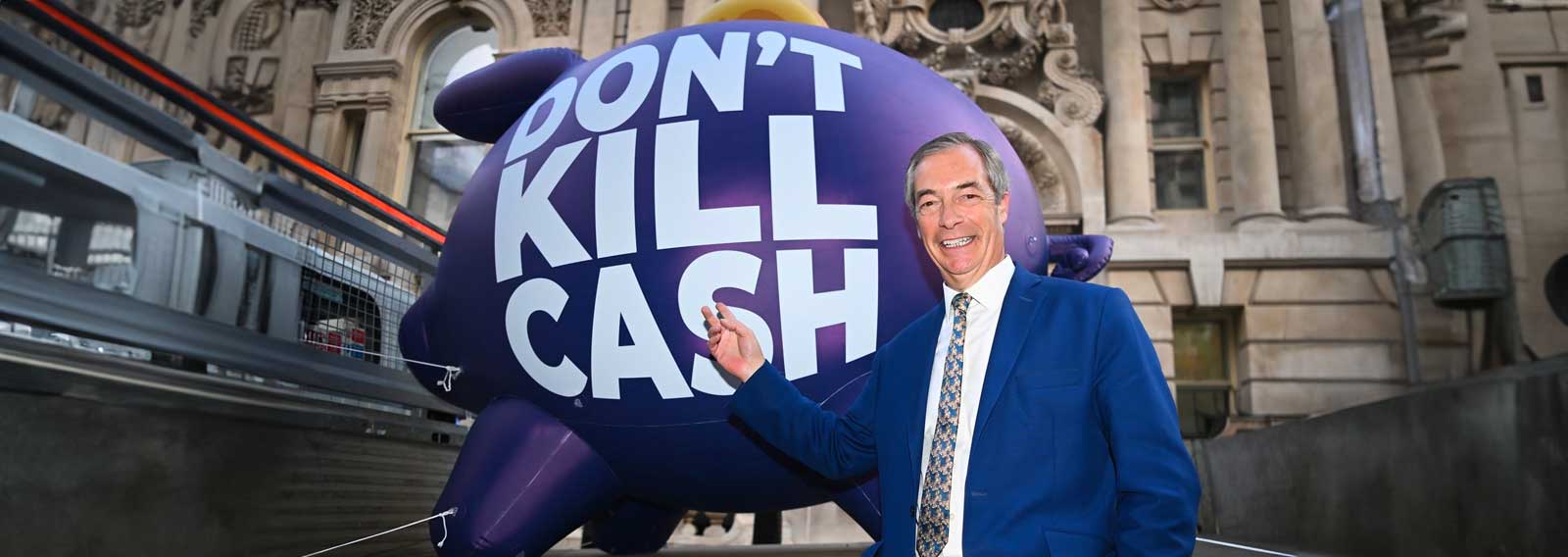

GBN, alongside Nigel Farage, are demanding the government “legislate to protect the status of cash as legal tender in the UK up until at least 2050.”

Post government “pandemic” mandates, businesses have adopted the card-only culture, shifting away from hard currency to digital transactions.

“With the rise of Apple and Google Pay, vulnerable people who rely on cash are increasingly being left behind by the relentless march of technology.

“More than five million adults still rely on cash in the UK. It’s used in six billion transactions every year,” GBN’s petition page argued.

Don’t Kill Cash is about deflecting a totalitarian agenda, they explained.

“There are strong vested interests pushing for cash to be permanently replaced by debit, credit cards and other electronic payments.”

“These cost you more in the long run and enable 3rd parties to track you, and what you’re spending.”

GBN’s Patrick Christys unleashed a bunch of pointed reasons for why discerning voters should lend their name to the pushback.

Preserving cash preserves freedom.

“Ask yourselves this: who does a cashless society benefit?”

“Big business, big corporation, big banks, fraudsters, and totalitarian regimes.”

A cashless society “gives total control to all the wrong people, and leaves you totally at their mercy,” Christys asserted.

For evidence, he pointed to de-banking.

This is the growing punitive practice of banks closing “the accounts of people who go against the establishment agenda.”

About this, he stated, “Just look at what’s happening to Nigel Farage, and a host of other anti-[left-wing] establishment figures.”

“We’ve seen governments freeze people’s assets if they went against the lockdown nonsense. We’ve seen companies like Paypal do the same.”

“How long,” he asked, “will it be before people get their assets frozen because they don’t go along with the LGBTQ+ agenda, or if they say the wrong thing about immigration?”

“I don’t want to live in a society where you’re one wrong word from going bankrupt. I dare say you don’t want that either.”

“This is a way of financially excluding people. Turning people into non-people,” he continued.

GBN’s “Don’t Kill Cash” campaign “isn’t just about stopping tyranny,” he added.

“It’s also about standing up for the rights of the marginalised. Cash is a lifeline for the elderly.”

“Forcing them to use phone apps to pay anything online is completely unfair.”

Besides this, what about cash-in-hand jobs, or rural communities without great internet access?

“What about the homeless who survive on people’s spare change?”

Seriously think about, “if there’s no cash to “fall back on you are screwed if someone cleans out your bank account.”

Also, consider the sentimental value of cash, “It’s a great way to keep the Queen’s memory alive,” he recounted.

“Aside from monetary value, there’s something special about getting money in a birthday card from loved ones.”

GBN’s concerns aren’t drawn from hysteria.

In April 2021 – so mid-CCP-19 – the Bank of England said that they and the U.K. treasury had created a task force to explore a UK Central Bank Digital Currency (CBDC).

The BoE announced that a CBDC “would be a new form of digital money issued by the Bank of England, for use by households and businesses.”

Reassuringly – although who knows how hollow this is – BoE stated, that if implemented, a centralised digital currency wouldn’t do away with cash.

Instead, a CBDC would “exist alongside cash and bank deposits, rather than replacing them.”

Jump forward to November of that same year.

In an update, the BoE announced the “next step.”

Moving from the investigative task force to the consultation stage, BoE said it was now testing the waters for market viability.

“If the results of this ‘development’ phase conclude that the case for CBDC is made and that it is operationally and technologically robust, then the earliest date for the launch of a UK CBDC would be in the second half of the decade,” the explanation reads.

Things are moving fast.

As of August 9, 2023, the BoE now has a plebian information page discussing what it calls “the digital pound (Britcoin).”

“The digital pound would be denominated in sterling and its value would be stable, just like banknotes,” said BoE.

“£10 in digital pounds will always have the same value as a £10 banknote.”

BoE then inferred Britcoin would only replace cash if people stopped using it.

GBN’s Don’t Kill Cash petition prompted the British government to respond, saying,

“GB News has it spot on – access to cash is incredibly important to many. It’s a choice that we are going to protect.”

Apparently spooked by the 300k+ who’ve signed the – keep cash and the freedoms which go with it – petition, the UK treasury added,

“We are acting now to protect access to cash in law and laying out that this means fee-free withdrawals and the availability of cash facilities within a reasonable distance – 3 miles.”

For now, GBN appears to have won.

How long this grassroots line in the sand holds, will depend on the backbone of bureaucrats, who, under pressure from the “eat crickets, bigots!” World Economic Forum, could easily backtrack, and ban cash altogether.