If the central bank of central banks, the Bank of International Settlements (BIS), is successful in getting their programmable crypto coin, a digital dollar, a CBDC, operating, it won’t last long. If that coin is linked to a control grid to electronically imprison us all, then I would say they have achieved the Mark of the Beast-like tech talked about in the book of Revelation, especially chapter 13. (There must be more to it though. Somehow human choice between God and Satan is involved. Spoiler alert! Choose God, not Satan, and you’ll be ok.)

I have no doubt that they can implement the technology for a cashless digital currency. China has already run a similar system via cell phones and control of people’s bank accounts and credit/debit cards.

But any system based on fiat currency is inherently terminal. How do I know that? All, 100% of all, fiat currencies have eventually returned to their intrinsic value. That is zero. Once hyperinflation sets in they are dead in the water. The users abandon them for some other currency that has not yet hyperinflated.

Globally all fiat currencies are linked to the US dollar. They are derivatives of the US dollar. Once the US dollar dies, and it will, because all fiat currencies have all died all other currencies will also die. It is just a matter of time.

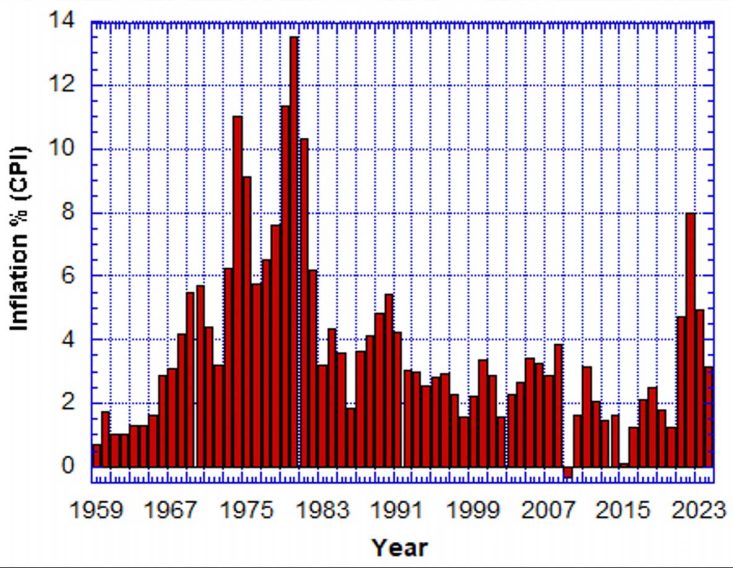

Here I have calculated the deflation of the US dollar based on the M2 currency creation by the US Federal Reserve (the FED) and the banks through debt creation from 1959 to December 2023. In the beginning of 2020, they commenced the COVID pandemic and massive currency creation. The US Federal Reserve issued over $3 trillion dollars in new credit flooding the markets like never seen before.

My modelling shows you that $1 in 1959 deflates in value and by January 1, 2024, it would take nearly $47 to buy the same commodity that in 1959 only cost $1. A US $1 one oz silver coin for example should cost USD $47 today.

What is the total inflation represented by this then? It is easy to calculate. The dollar is now worth 1/47th of it 1959 value. The 1959 $1 has dropped to 2% of its initial value, or 2 cents. It has lost about 98% of its value over the last 65 years. Imagine you put your money in a bank for safe keeping and 65 years later its value is only 2% of its initial value. This is total theft. Daylight robbery! And they do it without shame.

The very fact that the banksters tell us they want to steal from us at a rate of 2% per year, and they say they will work to keep it that way (between 2% and 3%), also tells us that the credit (‘money’) creation via debt issuance from the banks is one of the causes of price inflation. Possibly the biggest. But the 2% is another lie. According to officialdata.org the average price inflation rate has been 3.74% between 1959 and 2024. See chart above for the year-to-year official numbers. Those are the official data but to inflate $1 to $47 in 65 years you need an annual inflation rate of 6%, about 60% more than the official lie. The 8% they claimed in 2022 should really be 13%. Go figure.

Any digital coin not exchangeable for gold, or silver for that matter, is fiat and will go to zero value eventually. You can see that the US dollar is nearly there. Not long now before it is gone gone gone! But since all other currencies are based on the US dollar, they will follow suit. This includes any new CBDCs that they might come up with. They will die as the central bankster inflate the currency supply. They can’t help not doing that. If they didn’t the resulting currency crises would expose their theft. Well, it’s coming anyway!

This is a fait accompli, which is an action that is completed before those affected by it are in a position to query or reverse it. It often refers to a change or decision made by some authority on behalf of the people. Yeah right! But not on behalf of the people worse affected but for those who profit from stealing your wealth.

So whether or not CBDCs are eventually brought to bear on the global population and a Mark of the Beast-like control grid linked to them the future state control over your lives can only be temporary.

To add to that CBDCs are electronically created, traded and extinguished by the central banks. This can only accelerate their demise. The increase of the speed at which they are issued and traded will accelerate their deflation. More debt is issued per unit time because computers at the central banks can more rapidly directly issue more debt than if only commercial banks are involved. Not to speak of the current use of cash. CBDCs will bypass the local banks, which will no longer be needed. For this reason they will guarantee their own demise, and quickly too.

If you want an escape hatch out of this nightmare buy gold and silver, stuff you can hold in your hand. Not some share in an electronically traded gold pool either. Gold is money! Silver is money! Everything else is credit!

So don’t fear the “Mark of the Beast”! If successfully implemented though CBDCs it won’t last long. Temporarily it may work, so prepare accordingly. Long term all fiat currencies fall to their intrinsic value, zero.

You must be logged in to post a comment.